does doordash do quarterly taxes

The term quarterly taxes causes some confusion. There are no tax deductions or any of that to make it complicated.

Delivery Taxes Guide How To File Your Taxes As A Doordash Instacart Uber Eats Courier

Theres a problem with that caption.

. This should be an easy fraction to compute and cover you unless you start earning more than 4000 per quarter. There are no tax deductions or any of that to make it complicated. That makes it important to understand the DoorDash tax rules.

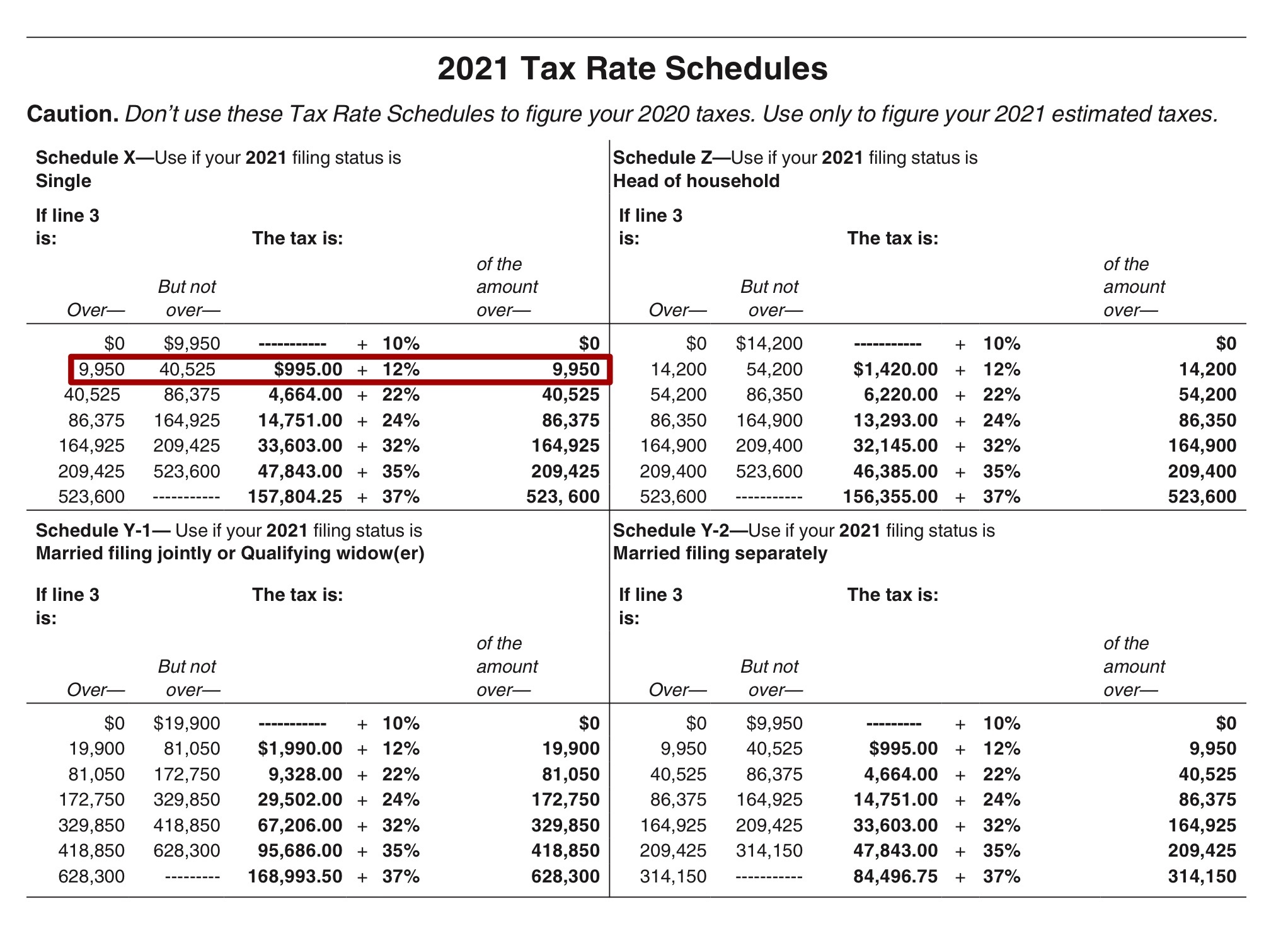

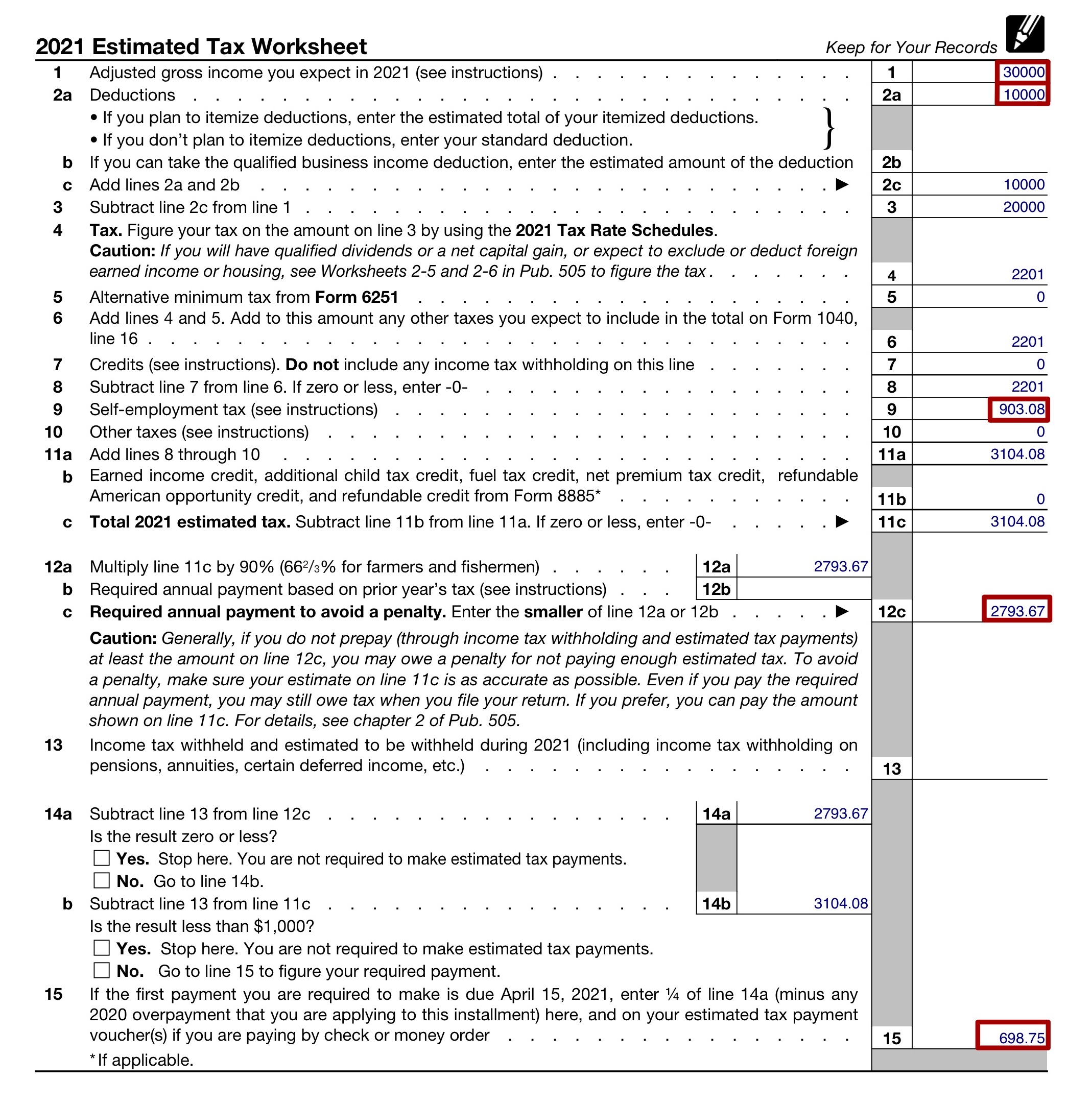

To pay the estimated taxes for Q1 you must total your DoorDash income for the quarter and multiply your income by 153. Paying quarterly taxes which arent actually quarterly by the way takes literally 30 seconds. If you made 5000 in Q1 you should send in a Q1.

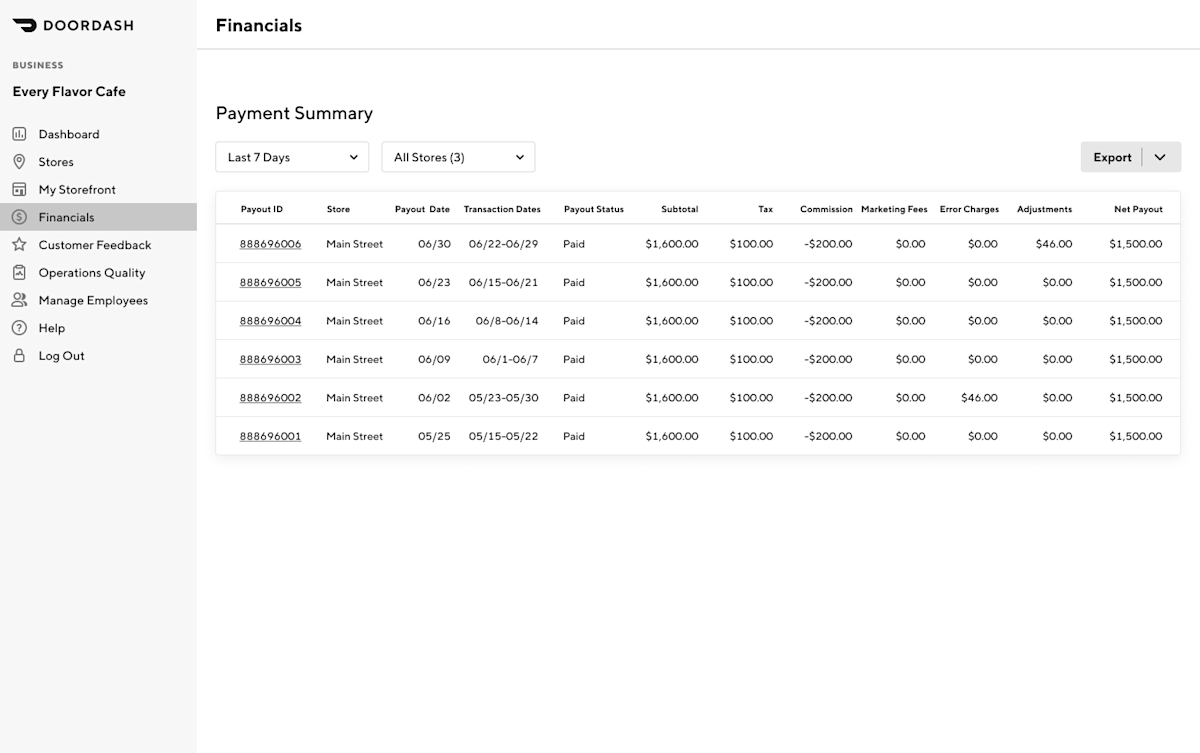

That is a phrase. DoorDash uses Stripe to process their payments and tax returns. Do you owe quarterly taxes.

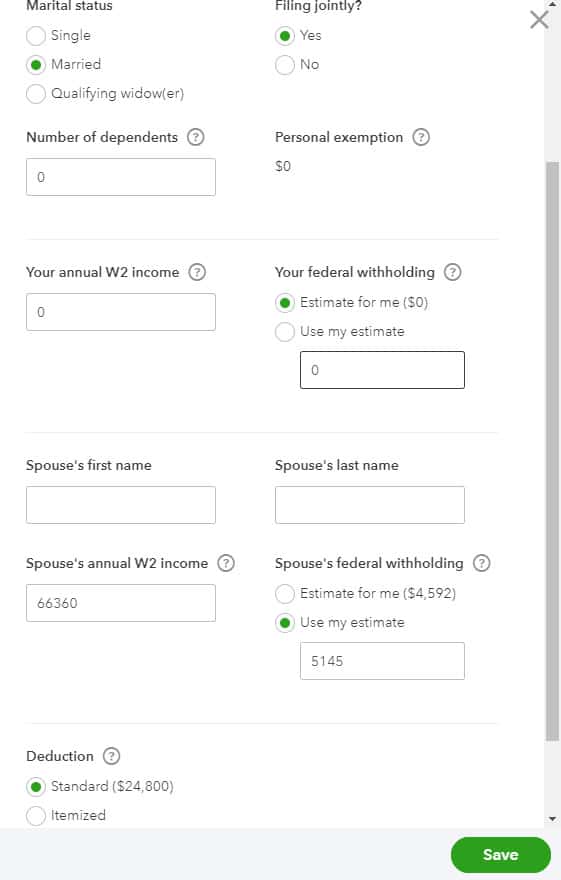

Since youre an independent contractor you might be responsible for estimated quarterly taxes. Since you are filing as self-employed you are liable for a 153 rate. This means if you made 5000 during 2021 for DoorDash your tax.

Does California Have An Inheritance Tax. Jul 20 2022 We recommend you put aside 30-42 of the profit you earn from Doordash. Since youre an independent contractor you might be responsible for estimated quarterly taxesespecially if DoorDash is your sole source of income.

The only real exception is that the Social. However if you deliver for Doordash you may need to make. If you earn more than 600 in a calendar year youll get a 1099-NEC from Stripe.

There is no such thing as quarterly taxes. DoorDash doesnt withhold taxes so youll. Do I have to pay quarterly taxes for DoorDash.

No tiers or tax brackets. Do you owe quarterly taxes. Make quarterly payments of 15 of your net income.

Theyll also send that form to. Dashers not eligible for a 1099-NEC- Since you have earned less than 600 dashing in 2021 you will not receive a 1099 form from DoorDash. You will end up paying 153 in Self Employment Taxes and between 15-25 in Federal and State.

You do PAY quarterly taxes if you expect to owe more than 1000 in taxes by the end of the year. If you earned more than 600 while working for DoorDash you are required to pay taxes. DoorDash does not automatically withhold taxes.

No tiers or tax brackets. You can pay online with. Starting this year if you made more than 600 on DoorDash DoorDash will give you a 1099-K showing the gross amount of credit card payments made to you.

What are the quarterly taxes for Grubhub Doordash Uber Eats Delivery Drivers. Yes - Just like everyone else youll need to pay taxes. How Do Taxes Work On Doordash.

How much do you pay in taxes if you do DoorDash. There is no additional quarterly tax for Doordash delivery drivers. Its a straight 153 on every dollar you earn.

DoorDash no longer uses. DoorDash drivers are self-employed rather than employees. Its a straight 153 on every dollar you earn.

How much did you owe in taxes DoorDash. It doesnt apply only to. Keep in mind that DoorDash.

Complete Guide To 1099 Doordash Taxes In Plain English 2022

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

How Do I File Estimated Quarterly Taxes Stride Health

Doordash Taxes And Doordash 1099 H R Block

My Door Dash Spreadsheet Finance Throttle

Paying Taxes In 2021 As A Doordash Driver Finance Throttle

How Do I File Estimated Quarterly Taxes Stride Health

.png)

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

When Are Quarterly Taxes Due In 2022 Dates To Bookmark

Prepare For Tax Season With These Restaurant Tax Tips

Common 1099 Problems And How To Fix Them Doordash Uber Eats Grubhub 2021 Entrecourier

Do I Owe Taxes Working For Doordash Net Pay Advance

Do Doordash Contractors Pay Quarterly Taxes Entrecourier

My Door Dash Spreadsheet Finance Throttle

Doordash Taxes Made Easy Ultimate Dasher S Guide Ageras

Doordash 1099 Taxes A Guide To Filing Taxes And Maximizing Deductions

Ultimate Tax Guide For Doordash Lyft And Uber Drivers For 2022 Youtube

Do 1099 Delivery Drivers Need To Pay Quarterly Taxes Entrecourier